loordsfilm.ru Learn

Learn

Who Has The Highest Interest Rate On Cds

A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. APY assumes interest remains on deposit until maturity date. Penalty for early withdrawal. This CD will renew automatically upon maturity. 2 APY is accurate as. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Because of this restriction, CDs can offer higher interest rates than other savings products. How much interest does $10, earn in a year? Save more with great rates on CDs · Product Features · Quick Links · CD Interest Rates · Frequently Asked Questions · Are CDs a good investment? · Can you lose money. The Rate Bump CD is a type of CD that allows you to lock in a rate for a specific term, and if we raise the APY and interest rate offered for your term, you can. Sallie Mae offers the best range of CD rates in , according to our exhaustive analysis of hundreds of banks. It earned the top rating of stars. Rates effective as of July 27, The margin interest rate is variable and is established based on the higher of a base rate of % or the current prime. If the penalty is greater than the earned interest, the remaining penalty amount is deducted from the principal of the account. The Regulation D Penalty is. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. APY assumes interest remains on deposit until maturity date. Penalty for early withdrawal. This CD will renew automatically upon maturity. 2 APY is accurate as. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Because of this restriction, CDs can offer higher interest rates than other savings products. How much interest does $10, earn in a year? Save more with great rates on CDs · Product Features · Quick Links · CD Interest Rates · Frequently Asked Questions · Are CDs a good investment? · Can you lose money. The Rate Bump CD is a type of CD that allows you to lock in a rate for a specific term, and if we raise the APY and interest rate offered for your term, you can. Sallie Mae offers the best range of CD rates in , according to our exhaustive analysis of hundreds of banks. It earned the top rating of stars. Rates effective as of July 27, The margin interest rate is variable and is established based on the higher of a base rate of % or the current prime. If the penalty is greater than the earned interest, the remaining penalty amount is deducted from the principal of the account. The Regulation D Penalty is.

CDs typically offer higher interest rates than high-yield savings accounts — but they work a bit differently. With CDs, you typically make one lump sum deposit. Frost Certificate of Deposit Account · Earn % APY on 90 Day Jumbo CDs · % · Higher rates worth your interest · We'll do our part to get you to and through. higher interest rates than savings or money market savings accounts. How do How is interest calculated and credited on my CD? We calculate interest. Southern Bank's best CDs feature rates up to % APY. Learn more about our CD rates or try our interest-earning calculator on our website today! Navy Federal Credit Union: % APY, $1, minimum deposit. Navy Federal Credit Union is the world's largest credit union with 13 million members. In addition. HIGH-GROWTH CERTIFICATES OF DEPOSIT · You always want to let your CD mature. If you withdraw your funds before any CD's maturity date, your interest rate is no. Higher interest rates are good news for your savings. Maximize your deposit earnings with our current CD specials. % APY* for 7 months. Earn %. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. But as. Lock in a guaranteed CD interest rate that offers competitive yields, higher returns, and is. FDIC insured up to $, 2. % APY 1. 7-Month CD. Lock in a. A certificate of deposit (CD) can allow you to enjoy higher fixed interest rates while still having all the security of an FDIC-insured 2 savings account. The highest locked-in rate we've found is through CommunityWide Federal Credit Union, which pays % APY on a 6-month term. A deposit of at least $1, is. I have the majority of my CDs at Marcus GS and have used them for years. I just purchased my first brokerage CD at Vanguard don't really like. Inova Bank offers one of the best CD interest rates today at % APY for 5 months. Who has the best online CD rates? Raisin offers the highest online bank CD. Competitive CD Rates. Savings Growth. · Competitive interest rates. Reach your goals faster with higher interest rates. · Guaranteed interest rate. Interest rates. A CD is a secure way to grow your savings with a higher interest rate than a regular savings account. At TowneBank, a personal banker can assist you in choosing. The Bask Bank 1 Year CD offers one of the highest interest rates at the bank. You also might like Bask Bank if you find one of the bank's savings accounts. Higher interest rates are good news for your savings. Maximize your deposit earnings with our current CD specials. % APY* for 7 months. Earn %. Compare CD Interest Rates. Your rate is based on the zip code. Update the zip code to see rates in your area. Update. Fixed Rate CDs by Term (Less than. With as little as $1,, you can begin earning a steady interest rate for the term of your Standard CD. Manage exposure to interest rate fluctuations with a CD ladder. If interest rates fall, the interest earned from the existing CDs would likely be higher than.

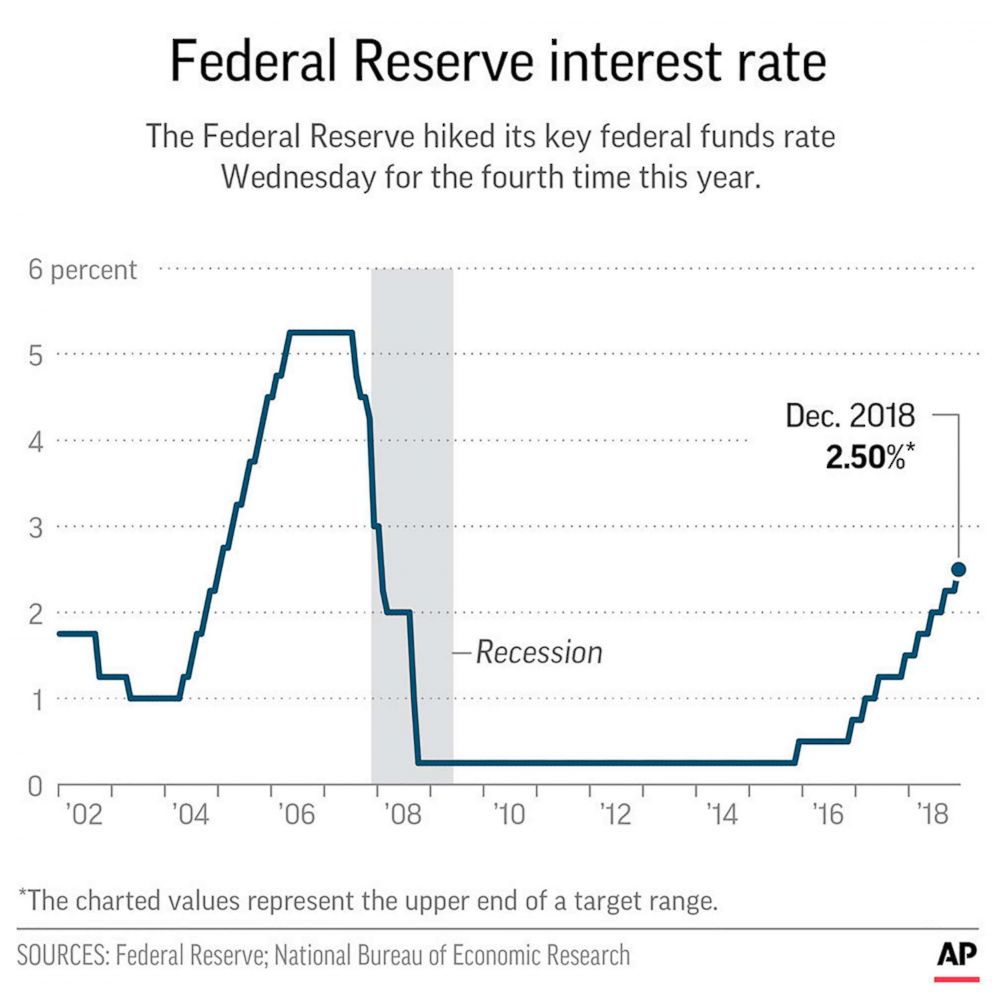

Fed Benchmark Interest Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. Fed rate, as implied by Day Fed Funds futures prices. See how changing FOMC expectations are impacting U.S. Treasury yields and key short-term interest. The federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their extra reserves to one another overnight. But at the conclusion of its June 11 and 12 policy meeting, the central bank announces that it's keeping its rate target between % and %—right where it's. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. rate. This is the benchmark interest rate that banks charge each other when lending their money held at the Federal Reserve. What are interest rates today. Key Takeaways · The federal funds rate is the target interest rate range set by the Federal Open Market Committee. · This is the rate at which commercial banks. In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. Fed rate, as implied by Day Fed Funds futures prices. See how changing FOMC expectations are impacting U.S. Treasury yields and key short-term interest. The federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their extra reserves to one another overnight. But at the conclusion of its June 11 and 12 policy meeting, the central bank announces that it's keeping its rate target between % and %—right where it's. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. rate. This is the benchmark interest rate that banks charge each other when lending their money held at the Federal Reserve. What are interest rates today. Key Takeaways · The federal funds rate is the target interest rate range set by the Federal Open Market Committee. · This is the rate at which commercial banks.

The Federal Reserve left interest rates unchanged once again at its For now, that leaves the central bank's benchmark interest rate between These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. The current Fed interest rate is %% as of 5/1/ See how current Fed rates decisions & Fed rate hikes have impacted US interest rates. Fed Funds Rate (Current target rate ), , , What it means: The interest rate at which banks and other depository institutions lend money to. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential. United States Federal Reserve Interest Rate Decision ; Nov 07, ; Sep 18, , %. The Federal Reserve's benchmark federal funds rate affects most other interest rates and influences the cost of debt and the value of savings. But at the conclusion of its June 11 and 12 policy meeting, the central bank announces that it's keeping its rate target between % and %—right where it's. Interest Rates > FRB Rates - discount, fed funds, primary credit Content Suggestions. FRED Blog. Unexpected changes to the benchmark U.S. interest rate. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. How Richmond Fed President Tom Barkin Sees the Economy Right Now This indicator shows the new target interest rate on the date the new rate was announced. Rate, or USD LIBOR, as the market's key benchmark rate on US dollar-denominated securities. It represents the broad cost of overnight (one-day) loans. In response, the Federal Reserve started increasing interest rates to cool the pace of rising prices, hiking its benchmark rate 11 times between March and. The Federal Funds Rate is the interest rate which banks charge one another for 1 day (overnight) lending. This American base rate is set by the market and is. The federal funds rate is the benchmark interest rate at which banks lend each other money. It has a direct bearing on many other rates and is the concept. The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR Report. FOMC Statements · FOMC Statement. July 31, The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately

Stock Ticker Data

Access free real-time & historical stock market data for + tickers via REST API in JSON format. Includes 72 exchanges and 30+ years of historical. Latest stock market data, with live share and stock prices, FTSE index and equities, currencies, bonds and commodities performance. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. 30 years of historical data for US market updated in real-time. minute delayed LSE data and End-of-day tick-level data for international markets are. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can indicate the future. To get a stock quote, you need to add a linked record for a company or fund. Then you can use another column to extract the price. View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more. Access free real-time & historical stock market data for + tickers via REST API in JSON format. Includes 72 exchanges and 30+ years of historical. Latest stock market data, with live share and stock prices, FTSE index and equities, currencies, bonds and commodities performance. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. 30 years of historical data for US market updated in real-time. minute delayed LSE data and End-of-day tick-level data for international markets are. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can indicate the future. To get a stock quote, you need to add a linked record for a company or fund. Then you can use another column to extract the price. View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more.

When you use the Stocks data type or the STOCKHISTORY function to obtain stock prices and other company information, that information is provided by another. ticker - The ticker symbol for the security to consider. It's mandatory to use both the exchange symbol and ticker symbol for accurate results and to avoid. 30 years of historical data for US market updated in real-time. minute delayed LSE data and End-of-day tick-level data for international markets are. This may impact the share price and makes for a busy trading day. Review months. March; June; September; December. FTSE U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Our equity and fixed income products provide real time data, analysis, charts, news, and tools to help you make decisions. Stocks market data JSON API. US & international stock market data with real-time streaming and historical data API. Free end of day stock market data and historical quotes for many of the world's top exchanges including NASDAQ, NYSE, AMEX, TSX, OTCBB, FTSE, SGX, HKEX. There are several other resources online to find historical price quotes. Online brokerage sites such as eTrade and TD Ameritrade or apps like Robinhood will. In the first three days, the S&P fell >7% triggered by a round of weaker than expected economic data, an aggressive unwind of crowded positions and a surge. Tick Data's core product is clean, research-ready, global historical intraday data. Our offering includes institutional-grade quote and trade history. Every trade and quote from the US stock markets for the last 20 years. Stream data in realtime or use our intuitive stock APIs. Stock price data for individual stocks. The following databases are good for getting current and historical stock data. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equities, fixed-income products. Save historical data from a mobile browser · Go to Yahoo Finance. · Enter a company name or stock symbol into the Quote Lookup field. · Tap a quote in the search. Download 20 years of historical data for over tickers - 1-minute, 5-minute, minute, 1-hour and tick data. Stocks, Futures, Options, Indices, FX. Historical Stock Price Datasets. Our historical stock datasets recap the days' trading activity in the underlying security. Files show open/high/low/close/. csv files. Feb note: I have just updated the dataset to include data up to Feb I have also accounted for changes in the stocks on the. Real-time market data feeds cover the various asset classes and markets in the NYSE Group to offer you insight into intraday trading activity. Category: Financial Indicators > Stock Market Data, economic data series, FRED: Download, graph, and track economic data.

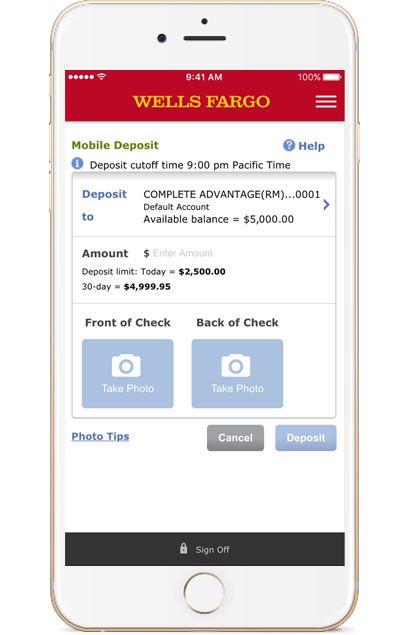

How To Send Money From Cash App To Wells Fargo

Enroll with Zelle to send and receive moneyExpand · Sign on and select Transfer & Pay on the desktop or Pay & Transfer on the mobile app. · Go to Send Money with. Transfer money between your different accounts. Move and manage your money 24/7 using Online Banking or the mobile app. Online Banking. Sign on to Wells Fargo Online to access transfers. Choose the account you want to transfer money from, the account you want the money transferred to, the. Zelle® has partnered with leading banks and credit unions across the U.S. to bring you a fast, safe and easy way to send money to friends and family. Pay online using your bank account, credit/Visa debit card1 or cash in-store. Track your transfer. You can easily track your transfer online or via our app. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Zelle® is a fast, easy way to send and receive money in our app. Learn more about Zelle. . Mobile and online banking when you need them. These funds are insured up to $, by the FDIC if Wells Fargo Bank, our If you want to use your account balance to send money to another Cash. My bank traces the wire to wells Fargo! They got the money and haven't released it or sent it back! Who do I call?! Enroll with Zelle to send and receive moneyExpand · Sign on and select Transfer & Pay on the desktop or Pay & Transfer on the mobile app. · Go to Send Money with. Transfer money between your different accounts. Move and manage your money 24/7 using Online Banking or the mobile app. Online Banking. Sign on to Wells Fargo Online to access transfers. Choose the account you want to transfer money from, the account you want the money transferred to, the. Zelle® has partnered with leading banks and credit unions across the U.S. to bring you a fast, safe and easy way to send money to friends and family. Pay online using your bank account, credit/Visa debit card1 or cash in-store. Track your transfer. You can easily track your transfer online or via our app. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. Zelle® is a fast, easy way to send and receive money in our app. Learn more about Zelle. . Mobile and online banking when you need them. These funds are insured up to $, by the FDIC if Wells Fargo Bank, our If you want to use your account balance to send money to another Cash. My bank traces the wire to wells Fargo! They got the money and haven't released it or sent it back! Who do I call?!

Sign on to the Wells Fargo Mobile app > Pay & Transfer > Zelle > Send > select + to add a recipient. Enter [email protected] and American Red. Take a look at your banking app — if you bank with a major institution like Chase, Wells Fargo, or Bank of America, you'll be able to access Zelle. What sets. Online money transfer FAQ · Click Pay & Transfer. · Select Account transfers. · Select the accounts you want to transfer money From and To and enter the amount and. Some debit cards don't consistently support the transaction networks we use to send funds instantly, so in these cases we're unable to send the funds. Tap the Money tab on your Cash App home screen · Press Cash Out and choose an amount · Select Standard ( business days) · Type “cashapp” in the search field. Compare ways to send and wire money using Wells Fargo Online, including Zelle, ExpressSend and Online Wires. Learn more about Cash App direct deposit. Review transfer options. Square offers multiple ways to transfer your money. Standard next-business-day transfers. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. For your convenience, you can find your upcoming transfers as well as the last 90 days of your transfer history when visiting the "Activity" section on loordsfilm.ru Locate the option to initiate a transfer or send money. Depending on your bank, this option may be labeled differently, e.g., "Transfer Funds," "Send Money," or. Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is available, you will. Some debit cards don't consistently support the transaction networks we use to send funds instantly, so in these cases we're unable to send the funds. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Here's how you can transfer money from one bank account to another! Keep watching to learn about the top 5 methods. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Sign on to Wells Fargo Online to access transfers. Select the account you want to transfer money from. Select the account you want the money transferred to. To get started, select the Transfer money page in online banking. If your account is eligible, you'll see an External account transfers tab as one of your. For domestic wire transfers using JPMorgan Chase, Wells Fargo, and Bank of Even if they don't have an account, you can send money from your Cash App balance. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. The minimum you can send is $ There are also limits on the total amount as well as the number of transfers you may send over various timeframes. For more.

1 2 3 4 5